A rights group, promoting openness in the oil and gas sector, Transparency Alliance Network, has appealed to President Bola Tinubu to avert moves by some interests in the Presidency to subvert the concluded bidding process to engage consultants for the Pre-Shipment Inspection Agents (PIAs) and Monitoring/Evaluation Agents (MEAs) under Nigerian Export Supervision Scheme (NESS) in the industry.

It said the bidding process for the Pre-Shipment Contract for PIAs and MEAs issued through the Ministry of Finance, Budget and National Planning was handled in line with the Procurement Act 2007 and other extant laws.

In a press release signed in Abuja yesterday by the group’s national coordinator, Zakary Musa Zubairu, he said after satisfying all the pre-qualification requirements, including expertise and tract record of experience, the contract was awarded to qualified Nigerian companies vide an approval letter referenced PRES/87/MF/314 dated May 15, 2023 by former President Muhammadu Buhari.

Zubairu, however, alleged that some “unscrupulous elements in Tinubu’s government are bent on thwarting the process and causing an ignominious policy reversal.”

He expressed optimism that such an action has no place in the Renewed Hope Agenda and continuity policy of the All Progressives Congress (APC).

Zubairu said those seeking to “exploit their closeness to power and the trust reposed in them by President Tinubu to enrich themselves should know that there’s no room for such criminality in this administration.”

He said, “We have very reliable and credible intelligence at our disposal that after passing through the bidding and pre-qualification process for the Pre-Shipment Inspection and Monitoring in the Oil and Gas sector, vested interests in the Presidency have removed the names of the companies that won the bid and replaced it with their preferred companies without recourse to the concluded process. This is not only criminal but a breach of the Procurement Act. We therefore demand its immediate reversal.”

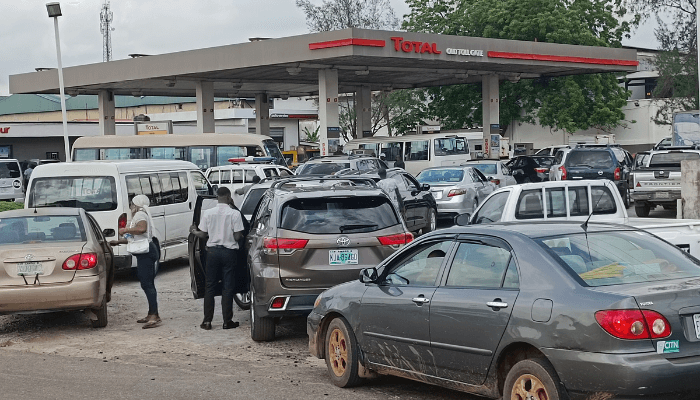

The group maintained that with the strategic importance of the Pre-Shipment Inspection and Monitoring in the verification of the quality, quantity, pricing, currency exchange rate and financial terms including monitoring and evaluating, it is important to follow due process and not resort to sharp practices that will further worsen the energy crisis Nigeria is currently facing especially with the removal of fuel subsidy in the country.

“As an anti-corruption think-tank, we are saddened by the barefaced illegality that’s been supervised by the exulted office of the Chief of Staff. Shortchanging the companies that rigorously went through the bidding and pre-qualification process and bringing unqualified companies without the requisite experience and expertise is a deliberate attempt to jeopardise the Tinubu administration and further worsen the plight of Nigerians who depend on the oil and gas sector for jobs and energy needs. The need to have competent companies to monitor and evaluate the sector is sacrosanct and we stand with the law and the good people of Nigeria to denounce any such rascality,” the statement added.