Vice President Kashim Shettima has announced that Nigeria will soon phase out its dependence on diesel generators and transition to an integrated hybrid energy system, marking a significant step in the country’s drive to cut carbon emissions and achieve sustainable development.

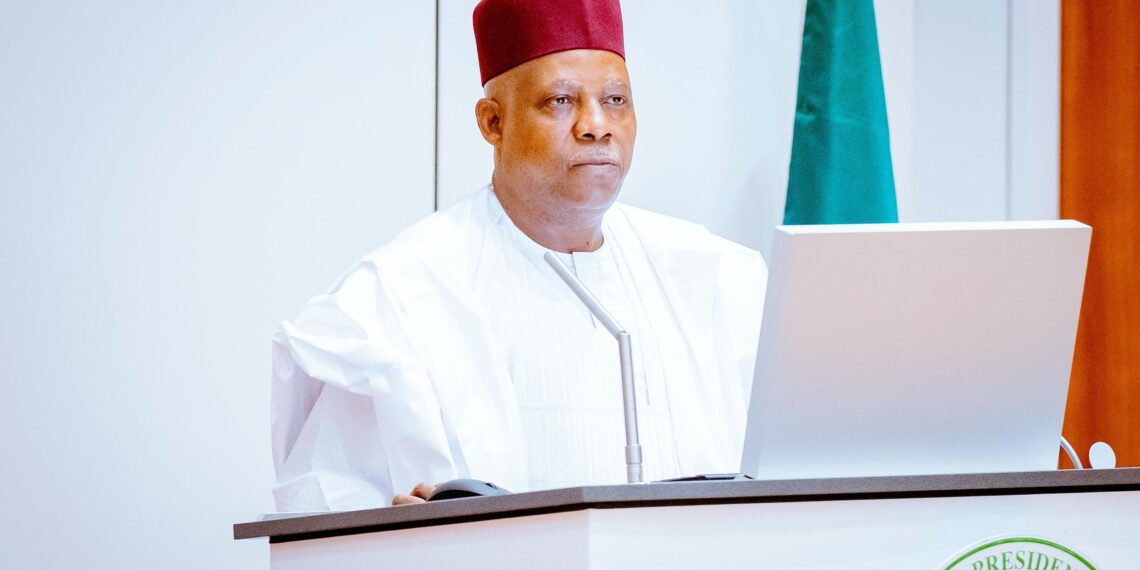

Speaking at the opening of the Decarbonising Infrastructure in Nigeria Summit (DIN Summit) in Abuja on Wednesday, the Vice President emphasised that climate action is no longer a luxury but a critical economic imperative for Nigeria’s future.

“Nigeria can no longer afford to build yesterday’s infrastructure for tomorrow,” Shettima declared, warning that unless the country aligns its climate ambitions with practical development realities, it risks being left behind by a rapidly changing world.

One of the highlights of the summit was Shettima’s announcement of plans to transform the Onne Port in Rivers State into Nigeria’s first fully green port.

Discussions with private investors are already underway to commit nearly $60 million to electrify the port using an integrated hybrid energy system.

Evening Roundup: Stories making waves in The Nation – The Nation0:00 / 0:00

“This is a strategic leap. Through an integrated hybrid energy system, we will phase out diesel dependency, slash carbon emissions, and provide 24/7 sustainable and affordable power to terminal operators and port users”, the Vice President stated.

According to Shettima, the DIN Summit is a product of months of stakeholder consultations and technical evaluations, driven by the realisation that profitability and sustainability must go hand in hand.

In a statement issued by Senior Special Assistant to the President on Media and Communications, Office of the Vice President, Stanley Nkwocha, Shettima said, “This summit reflects our belief that the path to net-zero by 2060 must be paved with concrete action, not convenient rhetoric”.

He cited Nigeria’s Energy Transition Plan and Climate Change Act as foundational tools for building a sustainable future, noting that 75% of the country’s greenhouse gas emissions stem from infrastructure-heavy sectors — energy, transport, urban development, and agriculture.

“These sectors are not just carbon-heavy; they form the arteries of our economy,” Shettima said, singling out agriculture, which supports over 70% of rural livelihoods.

“The only way out of the predicted doom is to decarbonise these systems”, he said.

“We are not here to fantasise. We are here to finance, to mobilise, to de-risk, to build. The Nigeria we want cannot be realised on diesel generators and fragile grids. It will not emerge from a model that chokes our lungs while draining our treasury. We must build a Nigeria whose infrastructure heals, rather than harms”, he added firmly.

Shettima further stressed the importance of unlocking climate finance, the summit’s central theme, saying it aligns with the urgent task of decoupling Nigeria’s development trajectory from outdated, carbon-intensive models while ensuring inclusivity.

He called for robust regulatory reforms and cross-sector policy harmonisation, noting the impending launch of a Green Investment Portal to connect capital with climate-smart projects.

“Decarbonisation must not stop at Abuja’s gates. It must reach every local government, every community, every home”, he insisted.

Earlier in the summit, Dr. Nkiruka Maduekwe, Director-General and CEO of the National Council on Climate Change (NCCC), highlighted Nigeria’s vulnerability to climate change despite contributing minimally to global carbon emissions.

“Although Nigeria’s contribution to global emissions is small, we are disproportionately affected due to our geographic location and low adaptive capacity,” Dr. Maduekwe noted.

She identified key transformation areas such as smart agriculture, renewable energy adoption, and improved land management to enhance carbon sequestration.

She also emphasised the need for increased private sector investment in sustainable infrastructure, particularly in overhauling Nigeria’s energy systems and transportation networks.

Also speaking at the event, Musaddiq Mustapha Adamu, Personal Assistant to the President on Sub-national Infrastructure (Office of the Vice President), underscored the federal government’s commitment to supporting state-level innovation in climate adaptation and green growth.

“Today’s summit is not just about emissions. It is about equity, economic survival, and building a future where infrastructure restores hope, uplifts society, and empowers the young, the poor, and the marginalised”, Adamu said.