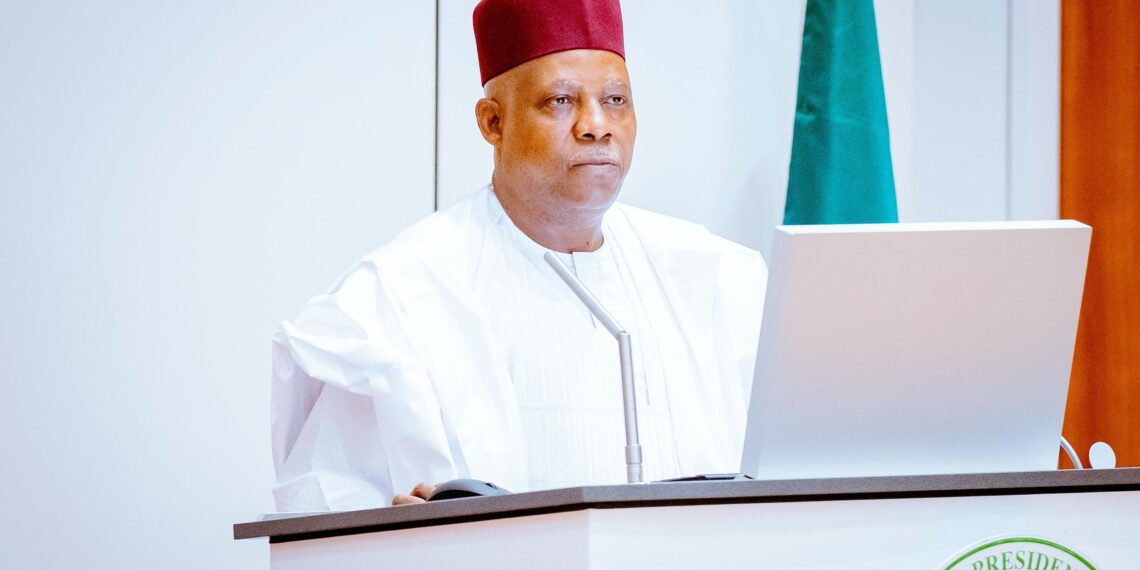

Vice President Kashim Shettima on Monday met with executives of the Vitol Group at the Presidential Villa in Abuja, where he called on investors to tap into Nigeria’s vast gas sector potential.

He disclosed that the Federal Government is actively advancing the $25 billion Nigeria-Morocco Gas Pipeline project, designed to supply natural gas to Europe.

According to him, the initiative aligns with President Bola Tinubu’s bold economic reforms, which have positioned Nigeria as a key investment hub in the global energy market.

“In the past 25 years, we haven’t had a leader as courageous as President Tinubu—he removed fuel subsidies, unified exchange rates, and initiated tax reforms,” Shettima said in a statement signed by Senior Special Assistant to The President on Media & Communications (Office of the Vice President), Stanley Nkwocha on Monday.

He urged global investors to support Nigeria’s energy transition, describing the gas sector as a model of stability and transparency.

The Vice President said, “I will urge you to key into our nation’s energy transition programme. I want you to utilise your dominance in the Liquefied Natural Gas (LNG) and Associated Petroleum Gas (APG) sub-sectors. The world is changing, and ours is actually a gas and not an oil economy. We have the eighth-largest gas reserve in the world. We really want to harness the potential in the gas sector fundamentally because of the stability and transparency in that arena.

“The Nigeria Liquefied Natural Gas Limited (NLNG) has been largely insulated from government interference. What we are getting from the NLNG is so predictable. This is why we are seriously exploring the option of taking our gas to Europe.”

The Vice President emphasized that the government is seeking not just capital, but also technical expertise for the project.

“We urge you to use your influence, contacts, and goodwill to mobilise resources for this project. It will be a completely transparent management structure. I will urge you to come on board with this project,” VP Shettima said, he told the Vitol delegation.

Vitol Group pledges continuous collaboration with Nigeria

In response, Vitol Group’s Chief Financial Officer, Jeffrey Dellapina, reaffirmed the company’s long-standing commitment to Nigeria.

“We do want to maintain an understanding that Vitol is committed, and we are always available to deploy capital when needed. We want to say that Vitol is committed to this country, and we want to stay in this country and evolve with you,” Dellapina said.

Also speaking, Murtala Baloni, Vitol’s Head of Public Affairs, highlighted the firm’s ongoing collaboration with Nigerian entities. He noted Vitol’s role as a key financier of Project Gazelle—a crude oil-backed forward-sale facility by the NNPC Limited—where it contributed $300 million during the COVID-19 pandemic.

What you should know

In June 2018, Nigeria and Morocco signed three agreements, which includes the Nigeria Morocco Gas Pipeline (NMGP) that will see Nigeria providing gas to countries in the West Africa sub-region that extend to Morocco and Europe

The line will pass through 15 African countries, boosting trade, development, and access to electricity in the region.

In Phase One, it will link Morocco to gas fields near Senegal and Mauritania, and connect Ghana to the Ivory Coast.

Phase Two will link Nigeria to Ghana, while Phase Three will connect the Ivory Coast to Senegal.

Morocco and Nigeria have set up a joint venture to manage the project.

At about 5,660km long, the pipeline is designed to reduce gas flaring in Nigeria and encourage diversification of energy resources in the country, while cutting down poverty through the creation of more job opportunities.